Design note 4 - what do we mean?

In addition to the similarities between our new icon and the real Northern Lights, we particularly liked some of the themes the Northern Lights icon represented, namely:

In addition to the similarities between our new icon and the real Northern Lights, we particularly liked some of the themes the Northern Lights icon represented, namely:

To complement our dynamic new Northern Lights icon, we needed a strong colour pallette and confident, contemporary font.

The contrasting yet complimentary colours in our logo symbolises our value of diversity and unity. We often talk about 'the same but different' at Beckfoot Trust to acknowledge that whilst we have a very clear One Trust identity and clarity on what remarkable means, we also know that one size does not always fit all.

Perhaps the most important part of our new Beckfoot Trust logo is the icon, shown to the right here.

We call it our Northern Lights.

In nature, the Northern Lights are seen as something unique and truly Remarkable that are associated with the North.

Our Northern Lights icon represents The Beckfoot Trust which is also on a constant journey to Remarkable and is strongly associated with the North of England.

As part of our ongoing Journey to Remarkable we felt it was important to give The Beckfoot Trust a strong, confident and contemporary logo and brand that was worthy of an organisation with such high standards and aspirations.

The new Trust logo was a departure from the previous logo style and was definitely designed with the future in mind.

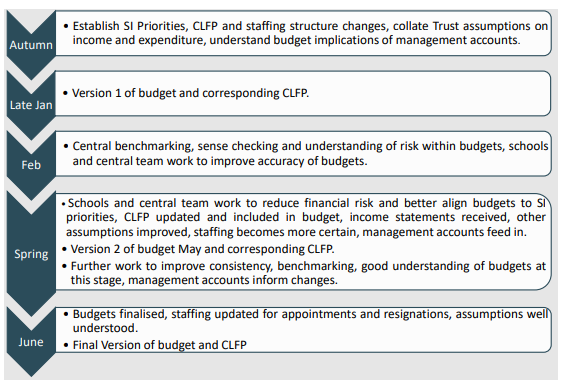

As a Multi Academy Trust, responsible for the education of thousands of young people across multiple schools, sound financial management is essential at Beckfoot Trust. The finance policy outlined in this document provides a comprehensive framework for managing the Trust’s financial affairs, ensuring that all financial transactions are conducted efficiently, effectively, and in accordance with the highest standards of accountability and transparency.

The scope and purpose of this finance policy is to promote sound financial management, ensure compliance with legal and regulatory requirements, and enable Beckfoot Trust to fulfil its mission of providing the highest quality education to its students.

This policy covers all aspects of financial management, including budgeting, procurement, accounting, financial reporting, risk management, and compliance and serves as a framework for achieving our strategic objectives and fulfilling our obligations to all stakeholders, including students, staff, parents/carers, and the wider community.

By implementing this policy, the Trust aims to ensure that all financial transactions are conducted with the highest standards of accountability and transparency, and that financial risks are identified, assessed, and managed effectively.

This policy has due regard to the following regulatory frameworks:

This policy also links to our Trust policies on:

We have a duty to comply with the 1995 ‘Nolan Principles’. The seven principles of public life apply to anyone who works as a public officeholder:

Selflessness – Holders of public office should act solely in the terms of public interest. They should not do so in order to gain financial or other benefits for themselves, family or friends;

Integrity – Holders of public office should not place themselves under any financial or other obligation to outside individuals or organisations that might seek to influence them in the performance of their official duties;

Objectivity – In carrying out public business, including making public appointments, awarding contracts, or recommending individuals for rewards and benefits, holders of public office should make choices on merit.

Accountability – Holders of public office are accountable for their decisions and actions to the public, and must submit themselves to whatever scrutiny is appropriate to their office;

Openness – Holders of public office should be as open as possible about all the decisions and actions they take. They should give reasons for their decisions and restrict information only when the wider public interest clearly demands it;

Honestly – Holders of public office have a duty to declare any private interests relating to their public duties and to take steps to resolve any conflicts arising in a way that protects the public interest;

Leadership – Holders of public office should promote and support these principles by leadership and example.

All members of staff are responsible for upholding these principles and should feel able to contribute towards the Trust achieving these aims.

| Role(s) | Key responsibilities |

| ‘Members’ of the Beckfoot Trust Company | • Oversee the governance arrangements of the Trust • Act as if they were the shareholders of a company • Power to appoint and remove Trustees • Attend the Annual General Meeting • Approve the Annual Financial Statements (Report & Accounts) |

| Trustees/Directors of the Beckfoot Trust | • Directors of the Trust are also the Trustees of the Trust • Responsible for the success of the Company by organising the Trust’s assets and operations • Responsible for establishing and approving the Scheme of Delegation • Ensure sustained success through regular meetings of the Board, Education Committee meetings and Business Committee meetings and Audit Committee meetings • Set the financial and operational strategy of the Trust |

| Chief Executive Officer (CEO) & Accounting Officer (AO) | • Personal responsibility to Parliament for financial resources under the Trust’s control. Must be able to demonstrate high standards of probity (doing the right thing and being seen to do the right thing). Oversees the Trust’s overall performance |

| Headteacher | • Responsible for financial oversight within their own school including budget setting and monitoring of forecasts • Responsible for the educational and business performance of the school |

| Deputy Chief Executive Officer (DCEO) | • Oversees and implements operational strategy of the Trust • Provides a key link between financial and operational practice within the Trust and ensures a co-ordinated approach • Manages operational risk and leads the operational team • Oversees the operational functions of the Trust |

| Chief Finance Officer (CFO) | • Oversees and completes implements the financial strategy of the Trust • Develops a coordinated approach to the Trust’s day to day financial practice • Responsible for the Trust financial reporting cycle and financial compliance • Provides the board with accurate and relevant financial information • Manages financial risk • Leads the finance function including transactional team, management accounts team and procurement team |

| Cluster Business Managers (CBMs) | • Contributing to development of Trust systems and procedures and ensuring implementation • Budget development and variance analysis • Liaising with the finance team |

Appendix 1 outlines our linked internal procedures and toolkit resources for our schools.

Importance

4.3.1 Key Control – IRIS Financials

All financial transactions of the Trust must be recorded in IRIS financials. This system is operated by the finance team and consists of:

Access to IRIS financials is controlled by the IRIS financials administrators who have access to amend the system, set up controls and determine the appropriate level of user access by user. Access is via a unique username and secure password.

Backups are the responsibility of the software provider and are run daily in line with the service level agreement.

The levels of access are listed below. There must be appropriate segregation of duties in all processes.

| Access level | Access to |

| Requisition only | PO system only • Input order requisitions but not approve |

| PO approver access | PO system only • Input order requisitions and approve them Complete goods receipts Authorise invoices for payment |

| Read only accounting access | PO system • Input order requisitions and approve them • Complete goods receipts • Authorise invoices for payment Accounting • Read only access to ledgers |

| Finance access | PO system • Progress requisitions to orders Accounting • May input transactions and amend ledgers Bank Details • May not amend bank details of suppliers |

| Procurement access | PO system • Progress requisitions to orders Accounting • May input transactions and amend ledgers Bank Details • May amend bank details of suppliers |

4.3.2 Key Control – IMP Budget Software

IMP is used for producing management accounts and budgets. Access to the software is managed by the CFO and is restricted to the following levels. Backups are the responsibility of the software provider and are run daily in line with the service level agreement.

| Access level | Roles |

| Read only – all areas | • Headteachers • CBMs • DCEO • CEO |

| Read only – income and expenditure | • Finance Operations and Procurement Team |

| Write access | • Management accounts team • CFO |

4.3.3 Key Control – Every Contract Management and Fixed Assets

The Trust’s contracts and fixed assets are managed through our EVERY system. Access is managed via the Central Team

4.3.4 Consistent Chart of Accounts

Using consistent nominals and cost centres across the Trust is critical for consistency, supporting data analysis, spotting errors, supporting procurement, and producing accurate and reliable management accounts.

The Trust uses the DfE Chart of Accounts for its nominal structure with some slight amendments to enable the appropriate recording of capital.

The Trust also operates a consistent set of cost centre codes with some cost centres being universal across all schools and some being specific by phase.

New cost centres must not be added without consultation with the Finance Manager.

Importance

4.4.1 Key Controls

Importance

4.5.1 Key Controls

4.5.2 Month End Procedures

The month end procedures are critical to ensure that the accounts are up to date and accurate and allow any issues or errors to be picked up and corrected promptly.

The month end procedures must be performed monthly.

| Month end task | Explanation |

| Fixed asset reconciliation | Ensuring the asset management system matches the finance system |

| Budget holder reports | Reviewed and shared with budget holders – issues highlighted |

| VAT return | Performed and submitted to HMRC |

| Multipay card account reconciliation | Checking that expenditure on Multipay cards is balanced |

| Control account reconciliations: • Debtors • Creditors • Petty Cash • Paying in slip • Recharges • Student Ledger • Staffing Ledger • Accruals • Prepayments | Pick up any anomalies and correct them to prevent detrimental impact on the management accounts |

| Review of journals | Pick up issues and corrections being made |

| Review of outstanding purchasing orders | Ensure that accounts are as up to date as possible and that goods are not outstanding |

Importance

4.6.1 Key Controls

If financial controls are not adhered to, explanation will be sought, and disciplinary action may follow.

Importance

4.7.1 Key Controls

Importance

4.8.1 Key Controls

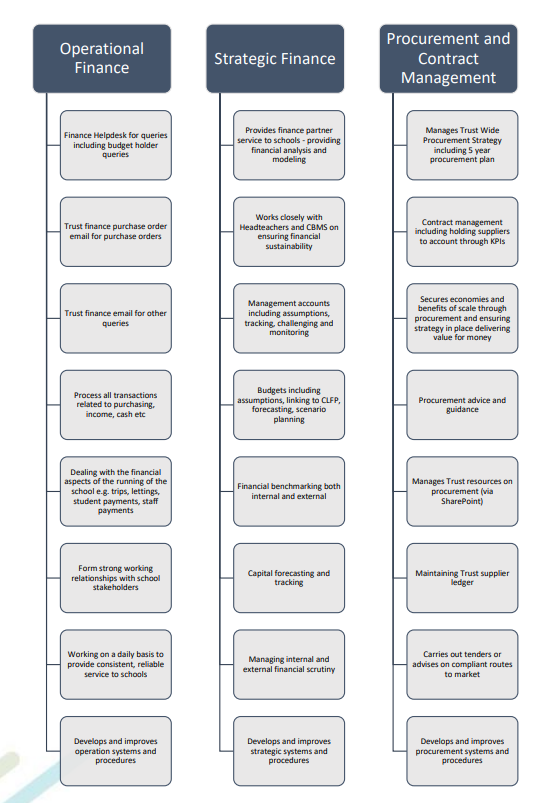

The aim of the Trust is to have an effective and efficient procurement function which supports schools through facilitating economies and benefits of scale.

Trust wide contracts are managed through the 5-year procurement plan and will be facilitated by the Procurement Manager and led by the contract holder.

Contracts are recorded on the EVERY contract management service.

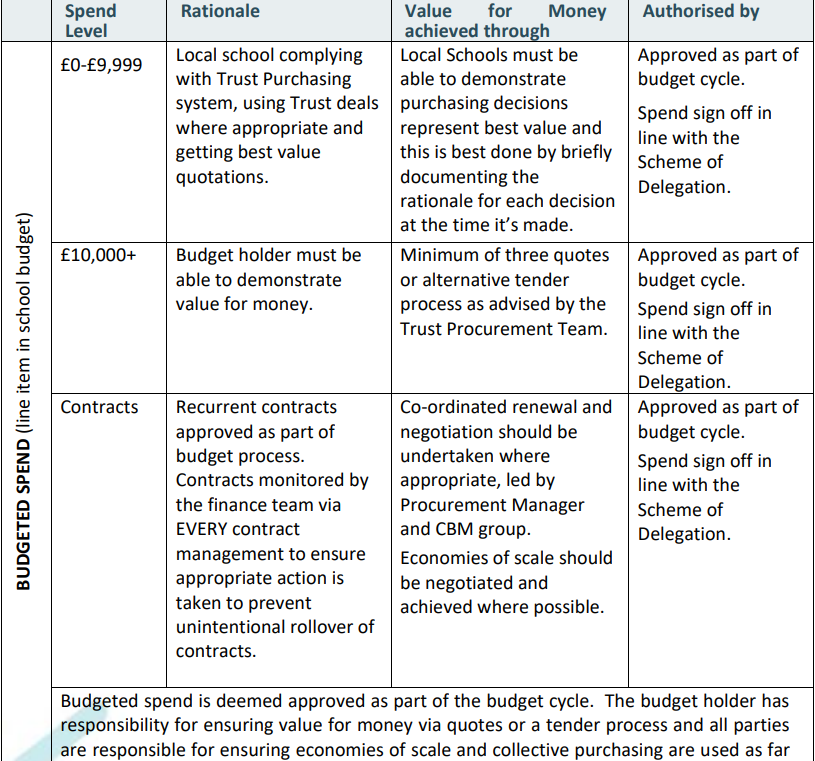

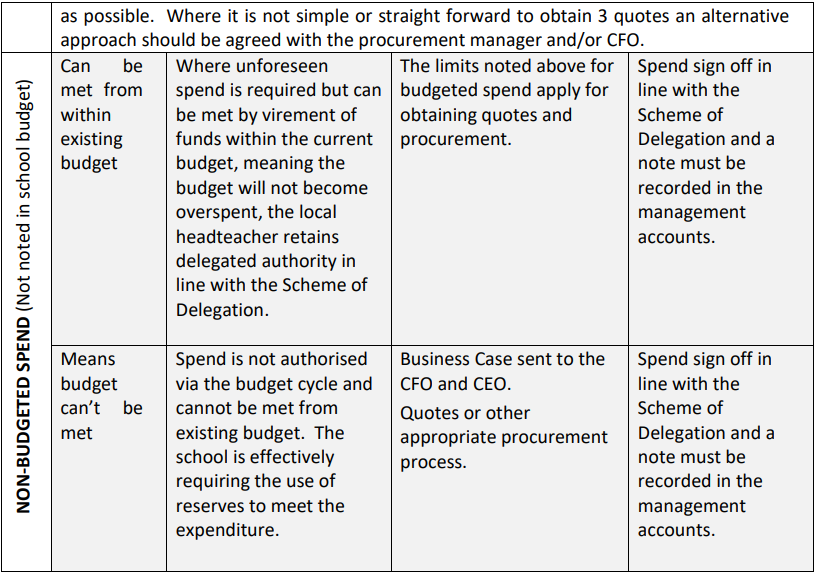

Where an item is likely to cost over £40k per year the Procurement Manager should be contacted for advice surrounding procurement. In all instances the below table should be referred to with regards to value for money.

When undertaking any type of procurement there are several options open to staff to ensure value for money is achieved. These are listed in the value for money section below and the appropriate option depends upon the value of the procurement, the type of good/service. As a Trust achieving value for money is critical, the following strategies may be employed to achieve value for money:

If required, the Procurement Manager should be contacted for advice when considering running a procurement.

As a Trust we take our responsibilities under modern day slavery legislation very seriously. When entering contracts with new suppliers they should be made aware of the Trust’s Modern Day Slavery Code of Conduct for suppliers.

4.8.2 Related Party Transactions

Everyone associated with the Trust must strive to avoid any conflict of interest between the interests of the organisation and personal, professional, and business interests on the other. This includes avoiding actual conflicts of interest as well as the perception of conflicts of interest.

A related party transaction can be with anyone who works / volunteers for the Trust. The premise behind the control is to ensure that no supplier has an unfair advantage of receiving work based on their former / current relationships. This is not to say it cannot take place, but that it is declared and transparent and that they have been through a fair process to get the work. We act in accordance with the current Academy Trust Handbook.

Trustees, LSC members, senior Leadership teams, executive leaders, central team members, ICT teams, finance teams, HR teams and premises teams are required to submit an annual declaration of interest.

Importance

Control over Trust suppliers ensures:

4.10.1 Key Controls

Where a new supplier is required a new supplier form must be completed

Alternative suppliers may be suggested where appropriate.

The procurement team will approve new suppliers where the below checks are satisfied

The ability to add/amend suppliers including the bank details is limited to the Procurement Team and must be authorised by the Procurement Manager, Finance Manager or CFO.

All amendments to the supplier’s details must be checked by another member of the Finance Team.

Independently verified means confirmed verbally with the supplier by telephoning a number obtained from an independent source (not an email or invoice or incoming correspondence from the supplier).

All staff must be vigilant when it comes to requests to change standing data.

In line with regulations in Managing Public Money the Trust will only consider payments in advance in exceptional circumstances of where the services are minor such as training courses or conference bookings. Exceptional circumstances are when a value for money assessment demonstrates there is a clear advantage in early payment. This value for money assessment must include a review of the suppliers’ financial circumstances and document the benefits of early payment.

Where it is agreed a payment in advance is necessary it should be made so far as possible by multi pay card to offer the Trust additional protection.

Importance

4.12.1 Key Controls

Importance

4.13.1 Key Controls

Importance

4.14.1 Key Controls

All payments must be approved in line with the Scheme of Delegation before payment. Paylists are run weekly and must be authorised by three people as below. Faster payments may be made where there a business requirement to do so. They must also be authorised by three people as below and bank details must be verified for all faster payments.

Creating the paylist

Checking the paylist

First Bank approval

Second Bank Approval

Authorisation Limits

Banking limits are listed below.

There may be occasion when the individual transaction limits are too low for a single payment. When this occurs only the CFO may alter the transaction limits after ensuring that the payment is genuine and appropriate. The change will be documented and changed back immediately following the transaction payment.

| Limit Type | Limit and authorisation limits |

| Chaps – Individual Transaction | £15,000 |

| Faster Payment – Individual Transaction | £25,000 |

| BACS – Individual Transaction | £170,000 |

| BACS – Batch limit | £1,000,000 |

Remittances

Sent to suppliers immediately following the payment

The Trust derives the majority of its income through grants received through the ESFA but does also have various other income streams. Recording income accurately is critical to ensuring the completeness of income, that income has been spent for the purposes intended and the accuracy of income and management account reporting and budgeting.

4.15.1 Key Controls

All schools within the Trust must act in accordance with the Trust’s Charging and Remissions Policy at all times.

Invoiced Income

Importance

4.16.1 Key Controls

Bad debts are reviewed on a regular basis.

Overdue debts are escalated as set out below.

| Overdue by | Payment limit and authorisation limits |

| 1 week | Statement sent |

| 2 weeks | Statement sent and follow up call advising that payment is overdue, payment date requested from customer, bad debt letter 1 sent |

| 3 weeks | Statement sent, bad debt letter 2 sent, further follow up call, payment date requested, advise that services will be put on stop |

| 4 weeks | Services on stop, statement sent, bad debt letter 3 sent |

| 6 weeks | Bad debt referred to small claims court |

Where all means of recouping the debt have been exhausted, permission must be sought from the Board to write off a bad debt.

Discretion over the timeline may be exercised by the Finance Manager, in agreement with the school, given contact with the customer.

Importance

Payroll costs are the largest element of Trust expenditure, and it is therefore essential that the financial procedures and internal controls in relation to payroll ensure staff are paid correctly and ensure that staffing costs are appropriately budgeted.

4.17.1 Key Controls

HR perform the following checks on payroll:

Headteachers perform the following checks and approval payroll for release:

Finance performs the following checks:

Processing payroll

Importance

4.18.1 Key Controls

Cash

Beckfoot Trust is a cashless environment for routine transactions wherever feasible. All payments for fees, purchases and other common transactions must be conducted through electronic payment means.

By prior agreement cash may be used for specific items related to the curriculum, for example, life skills curriculum field trips, equipment shop as part of a behaviour scheme.

In cases where cash payments are accepted this must be managed within the school by a designated staff member who must manage the cash, record, and collect receipts and ensure the cash is kept in a safe. A reconciliation of the cash must be performed monthly.

Cash floats must not exceed £200 and total cash onsite must not exceed £750 for insurance purposes.

Where cash needs to be deposited in the bank the finance team should be notified and will arrange to bank the cash.

Charity Collections

Where a school is collecting money for a third-party charity this must be handled within school, the collection does not form part of the Trust finances and therefore cannot be treated as such. Cash should be collected in sealed buckets, provided, and collected by that charity and agreed with the charity in advance.

Bank Accounts

The Trust has one bank account held at Lloyds Bank which is used to manage all the funds of the Trust.

Banking Deposits

The Trust utilises deposit accounts with its banker Lloyds to gain a return on its cash. The CFO implements the Board defined deposit strategy with the aim of minimising risk to Trust cash and maximising return. Interest is paid into the Trust bank account and held in the central budget, reducing the central charge for all schools.

When considering a deposit, the following things are considered:

Banking Reconciliation

The bank reconciliation must be performed on a regular basis, during busy periods this should be weekly but at a minimum must be done monthly.

All bank transactions must be entered into the finance system promptly.

Standing Orders and Direct Debits

Standing orders and direct debits are not the preferred method of payment however they may be the only way a supplier will accept payment or there may be commercial reasons for paying in this way. Where this is the case, standing orders and direct debits may be approved in line with the Scheme of Delegation based on the likely cost for the year. There must also be approval from two bank signatories.

Bank Signatories

The bank mandate requires two signatures for all banking transactions and alterations to the banking set up. The bank signatories are listed below as are the roles who have access to online banking and the permission levels. Key controls around making payments from the bank are listed in the payments section of this policy.

Sharing of online passwords and access is not allowed between staff.

Bank and Online Access

| Staff role | Bank signatory | Online banking access |

| CEO | Yes | No |

| DCEO | Yes | No |

| CFO | Yes | Yes – Admin Access. Authorised to alter payment limits – see 4.12-13 Payments section |

| Lead Management Accountant | Yes | Yes – Admin Access. Authorised to alter payment limits – see 4.12-13 Payments section |

| Finance Manager | Yes | Yes – standard access. Import and authorise payments |

| Assistant Finance Manager | Yes | Yes – standard access. Import and authorise payments |

| Finance Officer | Yes | Yes – standard access. Import and authorise payments |

| Management Accountant – Banking | No | Yes – standard access. Import and authorise payments |

Importance

4.18.1 Key Controls

| VAT rate | Finance system code | Type of income |

| Non business/outside scope | X | GAG Other DFE/EFA Grants Other government grants School Trip Income Bank Interest Inter Trust transfers Student Meals Donations Salary recovery – Teaching staff Charity collections |

| Standard rated 20% | S | Prom Income School Productions Catering Facilities Sports Kit (Size Dependent) Stationery (unless at cost) Staff meals Salary recovery – Non-Teaching Staff Sales to students for profit |

| Zero rated 0% | Z | Uniforms Stationary (at cost and portable) |

| Exempt 0% | E | Lettings of sports facilities Lettings of space |

4.20.1 Key Controls

General Principles

Capital cannot be overdrawn in year and where this looks likely additional revenue transfer to capital should be undertaken. This decision must be taken with reference to the Scheme of Delegation.

Capital spend must be on capital items, which may or may not be capitalised as fixed assets. See 4.20 Fixed Asset Management System.

SCA

The Trust receives School Condition Allocation funding annually from the DfE. This is capital funding for improving the estate of the Trust and is managed centrally by the Head of Estates. When considering the allocation of the funding consideration is given in the following order:

ICT

Spend is managed over a 5-year period through the 5-year ICT plan for each school. The 5-year plan considers the IT needs of the school and calculates what the financial cost of this will be. As part of the regular budget cycle the school will work out what the contribution to the IT pot needs to be considering:

Each school has an IT pot which is used for the purchase of ICT items, both consumable items and items that will be capitalised. The IT pot may have a carry forward at the end of any financial year because of required future year spend.

The balance in the IT pot is reconciled monthly and reviewed annually with CBMs and Headteachers.

The ICT pot is funded in two ways:

Other Capital Spend

This may be on fixtures fittings and equipment or motor vehicles.

Other capital spend must be funded via revenue transfer to capital as all DFC is allocated to IT spend.

4.21.1 Key Controls

All assets must be recorded in EVERY if they are valued at £500 or over and will last longer than one year. In addition to this all IT equipment not deemed consumable should be tagged.

The value recorded in EVERY should be inclusive of delivery and install costs.

Asset categories are listed below alongside their deprecation policies. Depreciation is applied annually.

Fixed assets may be written off with the authority of the appropriate person as per the Scheme of Delegation depending upon the net book value of the item at the time.

Depreciation Policies

| Category | Depreciation policy |

| IT equipment | 4 years straight line |

| IT infrastructure | 4 years straight line |

| Fixtures, fittings, and equipment | 10 years straight line |

| Motor vehicles | 10 years straight line |

| Plant and equipment | 20 years straight line |

4.22.1 Credit Notes

Credit notes must be checked against purchase order, invoice and delivery note and entered into the finance system promptly.

A refund is requested as first choice or credit can be used against future invoices as appropriate.

4.22.2 Journals

Journals may be posted to correct errors.

The operational finance team may post journals, but every journal must have approval from the relevant Management Accountant, to ensure segregation of duties.

4.22.3 Staff / Trustee Expenses

See Expenses Policy.

Payments to staff must follow the same procedures as invoices from external suppliers.

4.22.4 Student Payments

Payments to students must follow the same procedures as invoices from external suppliers.

4.22.5 Insurance

| Cover | Key information |

| RPA | https://www.gov.uk/guidance/the-risk-protection-arrangementrpa-for-schools [email protected] 03300 585566 020 3472 5031 (overseas travel emergencies and claims) |

| Motor insurance | 01489 882110 (0800 302 9055) out of hours emergencies [email protected] |

| Engineering inspection | 0800 917 7207 [email protected] |

4.22.6 Special Transactions

The CEO must be made aware of the following transactions before they occur in order to ensure compliance with regulations:

4.22.7 Alcohol

Under no circumstances should Trust funds be used to purchase alcohol, this includes the direct purchase of alcohol and the reimbursement of expenses for the purchase of alcohol. Alcohol should not be served on school premises including at events organised by third parties and during lettings. This should be made clear to any organisation wishing to use or hire the school premises.